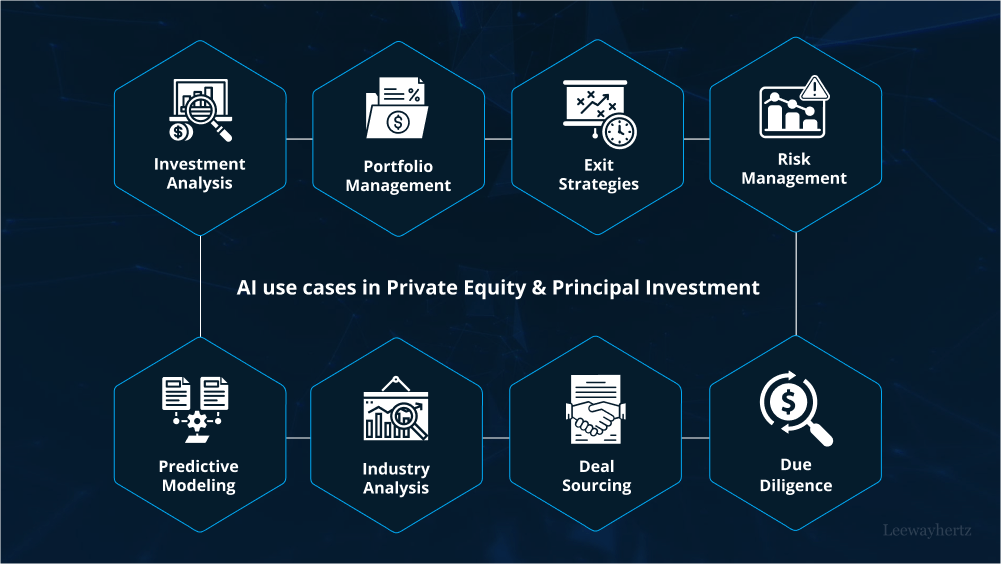

In recent years, the private equity and principal investment industries have witnessed a transformational impact from artificial intelligence (AI) technologies. These advanced algorithms and machine learning capabilities have enabled firms to make data-driven decisions, optimize investment strategies, and uncover valuable insights in an increasingly complex market landscape. This article explores the diverse use cases and applications of AI in private equity and principal investment, highlighting how these technologies are reshaping the industry.

- Data-driven Investment Decisions:

AI has revolutionized the way investment decisions are made by processing vast amounts of structured and unstructured data. Machine learning algorithms can analyze historical financial data, market trends, and company performance to identify potential investment opportunities. By leveraging AI, private equity firms can access deeper insights and predictive models, thus improving their investment selection process and overall returns.

- Risk Assessment and Mitigation:

AI plays a crucial role in risk assessment and mitigation strategies. Advanced algorithms can assess the risk associated with specific investments by considering various factors, including market volatility, economic indicators, and sector-specific trends. This analysis aids in optimizing portfolio diversification and managing potential risks, ultimately leading to better risk-adjusted returns.

- Enhanced Due Diligence:

During the due diligence phase, AI-driven tools can accelerate the process and provide more comprehensive analysis. Natural language processing (NLP) algorithms can efficiently review legal documents, financial statements, and contracts to identify potential red flags or opportunities. AI-driven due diligence also allows investment professionals to focus on higher-value tasks, making the process more efficient and effective.

- Sentiment Analysis:

AI-powered sentiment analysis helps investors gauge public perception and sentiment surrounding a specific company or sector. By monitoring social media, news articles, and other online sources, private equity firms can gain valuable insights into the market sentiment towards potential investments. This information aids in making informed decisions and adapting investment strategies accordingly.

- Portfolio Optimization:

AI algorithms can continuously analyze portfolio performance and market conditions to optimize asset allocation. By adjusting investments in real-time based on market shifts and performance indicators, private equity firms can maximize returns and minimize exposure to risk. This level of dynamic portfolio management was previously unattainable without the power of AI.

- Deal Sourcing and Lead Generation:

AI has enabled private equity firms to discover new investment opportunities through deal sourcing and lead generation. Automated processes can scan vast amounts of data to identify potential targets and trends that align with investment objectives. This reduces manual efforts and expands the scope of opportunities, making the sourcing process more efficient and effective.

- Valuation Modeling:

AI can significantly impact valuation modeling by incorporating advanced statistical techniques and machine learning algorithms. These models can analyze financial metrics, industry benchmarks, and comparable transactions to produce more accurate and reliable valuations. Enhanced valuation models contribute to more precise pricing during acquisitions and divestments.

- Exit Strategy Optimization:

AI technologies can also assist in optimizing exit strategies. By analyzing market conditions, industry trends, and financial indicators, AI algorithms can suggest the best timing and method for exit. This results in improved exit valuations and higher returns on investments.

- Regulatory Compliance:

Private equity and principal investment firms must navigate complex regulatory environments. AI can help by automating compliance monitoring and ensuring adherence to relevant regulations. Through AI-driven compliance solutions, firms can reduce the risk of non-compliance and associated penalties.

Conclusion:

AI has emerged as a game-changer for the private equity and principal investment industries. The applications of AI, from data-driven investment decisions to regulatory compliance, have revolutionized how investments are managed, risk is assessed, and opportunities are uncovered. As the technology continues to evolve, its integration in the sector is likely to deepen, providing firms with even greater potential for success in the future. However, as with any technology, it is essential to balance the power of AI with human expertise to achieve optimal outcomes in the highly dynamic and competitive world of private equity and principal investment.

To Learn More:- https://www.leewayhertz.com/ai-use-cases-in-private-equity-and-principal-investment/