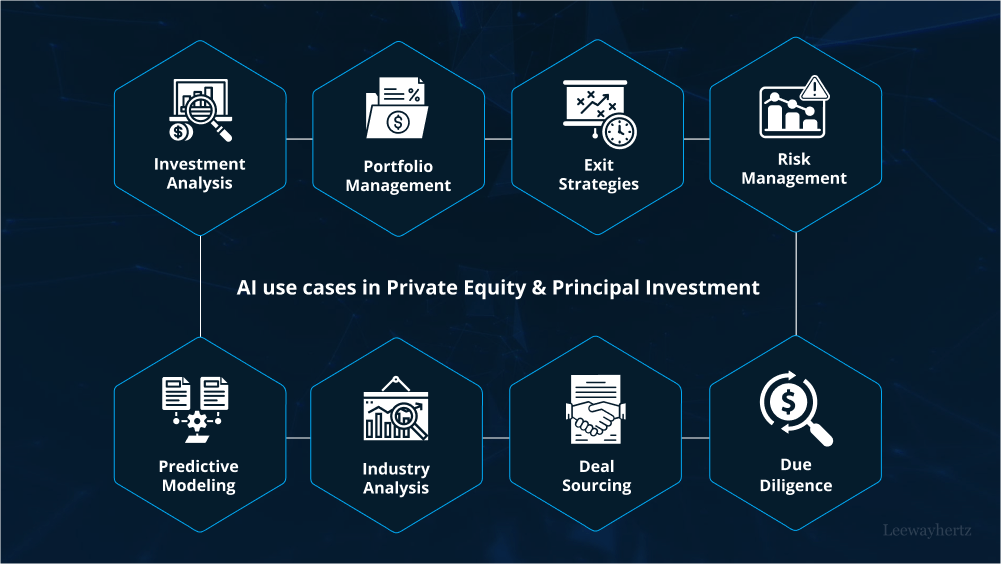

In recent years, the world of finance has been undergoing a transformative revolution fueled by advancements in artificial intelligence (AI) technology. Private equity and principal investment, traditionally characterized by complex decision-making processes and rigorous analysis, are no exception to this paradigm shift. AI is making waves in these sectors by streamlining operations, enhancing due diligence, and uncovering new investment opportunities. This article explores some of the most impactful AI use cases in private equity and principal investment.

1. Data Analysis and Prediction

One of the primary ways AI is transforming private equity and principal investment is through its capacity to analyze vast amounts of data at unprecedented speeds. Machine learning algorithms can sift through historical financial data, market trends, and economic indicators to identify patterns and correlations that human analysts might overlook. This allows investment professionals to make more informed decisions based on data-driven insights.

AI algorithms can also predict market movements and assess the risk associated with various investment options. By analyzing historical performance and contextual factors, AI models can provide predictions on potential returns, helping investors mitigate risk and optimize their investment strategies.

2. Due Diligence Enhancement

Due diligence is a critical aspect of private equity and principal investment, involving comprehensive research to evaluate the financial health and growth prospects of target companies. AI streamlines this process by automating data collection, uncovering hidden risks, and accelerating the assessment of investment opportunities.

Natural language processing (NLP) algorithms, a subset of AI, can analyze vast amounts of textual data, such as news articles, social media, and regulatory filings. This allows investors to gain insights into market sentiment, company reputation, and potential risks associated with an investment. By identifying potential red flags or market trends, AI-driven due diligence can significantly enhance decision-making accuracy.

3. Portfolio Management and Optimization

AI technologies enable private equity firms and investment professionals to optimize their portfolios for maximum returns and risk management. Machine learning algorithms can continuously monitor the performance of investments and adjust the portfolio allocation based on real-time data. This dynamic approach allows for quicker responses to market changes and the identification of new investment opportunities.

Furthermore, AI-driven predictive analytics can help investors identify underperforming assets and develop strategies to improve their returns. By analyzing various scenarios and historical data, AI models can suggest portfolio adjustments that align with the investor’s risk appetite and return expectations.

4. Deal Sourcing and Screening

Finding promising investment opportunities is a cornerstone of private equity and principal investment success. AI technologies assist in deal sourcing and screening by scanning vast amounts of data to identify potential targets that match predefined investment criteria.

Machine learning algorithms can analyze financial data, industry trends, and company performance metrics to identify companies with growth potential. This saves investment professionals time and resources that would otherwise be spent on manual research. AI-powered deal sourcing tools can provide a competitive advantage by uncovering hidden gems in the market.

5. Risk Management and Compliance

AI is also playing a crucial role in enhancing risk management and ensuring compliance within the private equity and principal investment sectors. AI models can assess the risk associated with various investment options by considering a wide range of factors, such as market volatility, macroeconomic indicators, and geopolitical events. This comprehensive risk assessment allows investors to make more informed decisions and better allocate their resources.

Additionally, AI-driven compliance tools can help investment firms navigate complex regulatory landscapes. By monitoring changes in regulations and automating compliance checks, AI reduces the risk of non-compliance and potential legal issues.

In conclusion, AI’s impact on private equity and principal investment is undeniable. From data analysis and due diligence to portfolio optimization and risk management, AI technologies are revolutionizing how investment professionals operate. As the technology continues to evolve, it is likely that its role in these sectors will only become more significant, paving the way for more accurate, efficient, and successful investment strategies.